Today’s budget wars would be unrecognizable to earlier generations of Americans.

Editor's Note: Charles S. Clark, a retired Washington journalist, updated this piece from his July 18, 2019, feature published in Government Executive. The recent author of “George Washington Parke Custis: A Rarefied Life in America’s First Family,” he writes a weekly column for the Falls Church News-Press.

The current game of budgetary chicken in Congress over a possible government shutdown was predictable last year when it became clear that Republicans would take control of the U.S. House. Newly elected Speaker Kevin McCarthy made it plain in January that his colleagues would attempt to use the regular bill that raises the government’s borrowing authority (the debt ceiling) as leverage to force spending cuts, given the staggering $31 trillion in federal debt.

President Biden, who, like McCarthy, enjoys nominal but unreliable party control of a chamber (the Senate), agreed to meet with the Republican leader, but with an avowal: Democrats would not negotiate under duress. Instead, he argued, Congress should continue its recent practice of passing a “clean” debt ceiling bill to protect our “full faith and credit” and to cover the expenses that have already been enacted. Biden challenged Republicans for the next budget cycle to specify their own proposed spending cuts — after gleefully chiding them for suggesting that past Social Security and Medicare be trimmed. He then proposed about $3 trillion in tax hikes and program cuts over 10 years in his March budget submission.

Biden’s proposal was excoriated by Sen. Chuck Grassley, R-Iowa as a “road map to fiscal ruin.”

Republicans are preparing a response they hope will enable McCarthy to cobble together 218 votes by June, when the Treasury Department estimates the government will run out of money. Ominously, this coming springtime clash is only a preview of the head-butting expected in September, when 12 appropriations must pass before the beginning of a new fiscal year. At risk: a government shutdown.

It adds up to a modern drama in which both the tactics and the eye-popping dollar amounts would be unrecognizable to past denizens of both ends of Pennsylvania Avenue.

George Washington never presided over a formal congressional budget, an anti-deficiency act, or a tactical government shutdown. The Constitution simply gave the power to impose taxes and borrow to Congress — with all raising of revenue originating in the House of Representatives. Under Article I, Section 9, funds may be drawn from the Treasury only through appropriations made by law, thus encouraging annual spending bills that are separate from policy legislation.

It wasn’t until 1870 that lawmakers enacted the first “Antideficiency Act,” followed by a major one in 1884. The acts were designed to end the executive branch’s long history of coercive deficiencies, during which federal agencies would intentionally spend all their funds, sometimes within the first few months of the fiscal year, knowing that Congress would feel morally obligated to provide them with more money after the fact. Among the worst culprits were the military and the U.S. Post Office, which, during one particularly scandalous episode in 1879, threatened to stop all deliveries after it overspent its budget by some $3 million dollars. The acts effectively made it illegal for agencies to spend more money than Congress had appropriated in a fiscal year, or "to involve the government in any contract for the future payment of money in excess of such appropriations.”

In 1905 and 1906, further amendments mandated all appropriations be apportioned in monthly installments and imposed criminal penalties for violations on officials. By 1921, a role for the president was made formal under the Budget and Accounting Act, which required the chief executive to submit an annual, comprehensive budget proposal to Congress. It also forced agencies to first submit their proposed budgets to the White House’s new “Bureau of the Budget,” renamed in 1970 as today’s Office of Management and Budget.

After President Nixon began blocking agencies from spending money on programs he disfavored, the Democratic-controlled Congress passed the 1974 Budget and Impoundment Control Act. It set up the modern annual schedule for budget submissions and debate, as well as the congressional budget committees and the analytical Congressional Budget Office.

By 1985 — with deficits at record levels — a bipartisan compromise produced an act that required efforts at gradual reduction and elimination of deficits over a six-year period, the enforcement including new powers of the president to order a blunt “sequester” that trimmed spending across the board.

The need for Congress to formally raise the debt ceiling to avoid an end-of-fiscal-year shutdown is a phenomenon largely of the past 40 years. The Senate and House have approached it differently, in some years passing the needed resolution several times a year, and sometimes with temporary extensions that allowed for painful negotiating. Many on today’s Capitol Hill recall the shutdowns of the 1990s, when newly empowered House Republicans under Speaker Newt Gingrich of Georgia twice forced agencies to close, while they demanded that President Clinton make spending cuts. President Obama was not spared by the threat; a negotiating stalemate in 2013 brought a 16-day shutdown.

How’s all that working out for us? A detailed examination of the state of play following a 35-day partial shutdown in 2018 during the Trump administration offers clues to the outcome of the still-unfolding fracas of 2023.

In April 2019, Rep. Louis Gohmert, R-Texas, delivered a favorite shutdown anecdote: During the 16-day governmentwide shutdown in 2013 under President Obama, Gohmert joined some World War II veterans in a visit to the Iwo Jima Marine Corps Memorial in Arlington, Va. The National Park Service had barricaded the site, Gohmert recalled at a 2019 hearing of the Natural Resources Committee on the Interior Department’s reorganization.

“I was absolutely appalled” that the nation’s veterans were “being harassed,” he said, describing a busload of veterans of the Iwo Jima battle who had arrived at the site and “busted up” the barricades. “We didn’t let the enemy keep us from getting to the top of Mount Suribachi,” the veterans reportedly said. “So, we won’t let a little wooden barricade keep us from the memorial.”

A National Park Service spokesman that May told reporters that the agency had no information on such an incident. But similar Republican attacks on the Park Service for closing war monuments to tourists during the 2013 appropriations lapse threw into relief a key difference between the two political parties.

Under the Obama administration, during an angry hearing in October 2013, Park Service Director Jon Jarvis resisted Republican attacks and defended the closing of war monuments as required by appropriations law. Consistent with the requirements of the amended 1884 Antideficiency Act, the service “was forced to close all 401 national parks across the country and furlough more than 20,000 National Park Service employees,” Jarvis told a joint hearing of the House Interior and Oversight panels. “Approximately 3,000 employees were exempted from the furlough to respond to threats to the safety of human life and the protection of property. Absent appropriations, the National Park Service will continue to implement the contingency plan that was approved by the Interior Department,” he said.

Rep. Darrell Issa, R-Calif. accused Jarvis of wanting to "inflict pain" to make a point about government funding. “Whose land are the parks?” Issa asked. “The people’s or the government’s?”

Democratic Rep. Peter DeFazio of Oregon countered: “When you decided to shut down the government two weeks ago, did you forget that the NPS is part of the federal government?”

Flash forward to January 2018, when, with a shutdown threatened under Donald Trump, Budget Director Mick Mulvaney promised the damage would be less than what occurred under Obama because the Democratic administration had “weaponized the shutdown in 2013.” By contrast, “we’re not going to try and hurt people, especially people who work for the federal government,” Mulvaney said.

So, during the 35-day shutdown that ended on January 25, 2019, the Trump administration took unusual steps to get around the Antideficiency Act. They called back furloughed Internal Revenue Service staff to prepare for tax-filing season and to implement the new tax law. They summoned Agriculture Department employees to keep the food-stamps program going. The State Department pressed ahead with a conference for ambassadors and chiefs of mission, with many State staff furloughed, and the Transportation Department recalled idled Federal Aviation Administration engineers and inspectors.

Is that allowed? Not according to the lawsuit filed by the National Treasury Employees Union, the National Air Traffic Controllers Association (which later dropped out), and a group of five federal workers. Also suspicious of the legality of the administration’s actions was Sen. Mark Warner, the Virginia Democrat who wrote to the administration to challenge such legal authority.

Chris Edwards, the longtime director of tax-policy studies at the libertarian Cato Institute, said that political calculations account for the differing approaches: “During the Obama administration, there was a shutdown or two when the administration did seem to go out of its way to make it more painful … Under Trump, the administration went out of their way to make it as least painful for voters as possible.” The reason, Edwards suspected, is that “there is a common perception going back to the two shutdowns in the mid-1990s that Republicans got mainly blamed, and that may be correct.”

Inside the Republican conference on Capitol Hill, “there has long been a perception that they need to fear shutdowns at all costs and always get blamed,” he added. “I think Democrats know that, so they have the upper political hand on shutdowns.”

Both parties seek to pin the blame on their opponents — using labels such as the “Trump shutdown” or “the Schumer shutdown” (for Senate Minority Leader Chuck Schumer). But opinion polls suggest the public does blame Republicans more, depending on who’s in the White House.

During the twin shutdowns in 1995-1996 — a two-part, 26-day clash between the Clinton administration and congressional Republicans over their proposals for deep cuts in Medicare and other domestic spending — a Washington Post-ABC News poll showed that 50% of respondents blamed Republicans, versus only 27% who blamed Clinton.

In the 2013 shutdown — triggered by a GOP effort to defund the Affordable Care Act — 53% in a similar poll said that Republicans were mainly responsible, versus 29% who blamed Obama.

Three weeks into the 2018-2019 partial government shutdown—set in motion after Trump abandoned a budget agreement with Congress and demanded greater spending on a Southwest border wall—an NPR poll showed that 54% of U.S. adults believed that Trump was most responsible, and another 31% said that congressional Democrats were at fault. Only 5% blamed Republicans on Capitol Hill.

The polls showed that shutdowns are “overwhelmingly negative, embarrassing, and hurtful to the economy and international relations,” said Paul Light, a professor of public service at New York University. Nonetheless, in the coming budget drama, Trump was capable of “blowing things up,” Light explained. “Democrats may be able to maneuver to push him into pulling the trigger, but he will not be able to blame it on the Democrats. People are clear he’s the chief executive.”

Norman Ornstein, resident scholar at the American Enterprise Institute, lamented the fact that shutdowns have “become a more regular occurrence. We’re writing not about historical anomalies, but about facts of life in governance now,” he said. “A lot of Republicans relish a shutdown because they don’t want government, don’t want it working.” That was apparent, he said, in 1995 and 1996 when Newt Gingrich drove “a shutdown during the holidays to discredit Clinton and make an ideological point.”

Bill Clinton recognized that some people think government does work and want more of it. His approach assumed that “the best way to end the shutdown was to gain, no doubt, some political advantage” by bringing to public attention the cost of shuttering government operations, especially things the public cares about, Ornstein said.

The modern situation is even more radical, he added, citing Trump Treasury Secretary Steven Mnuchin’s “willingness to give a middle finger to Congress, or act as if Congress is immaterial.” At the same time, the “Republicans’ end run around the Antideficiency Act,” Ornstein cautioned, doesn’t mean that they aren’t “pragmatic in making sure their political needs are met.”

But Chris Edwards at the Cato Institute takes a longer view. “Though Republicans get blamed in the short term as the party that’s anti-government, I don’t think shutdowns are bad for Republicans over the medium or longer term. People forget it,” he said. “Go back to 1996. Republicans got blamed, but only a few months later, the vast majority of the budget-cutters and shut-downers got re-elected.”

Members of both parties agree that the costs of shutdowns to government and the economy are formidable. The 2018-2019 shutdown delayed $18 billion in federal spending and cost the economy some $11 billion, according to the Congressional Budget Office. The estimate from the private S&P Global Ratings was $6 billion—or about what Trump had demanded for the border wall which triggered the breakdown in bipartisan budget talks. That record-breaker compares with a cost of $2.6 billion for the 2013 shutdown and $2.3 billion for the twin shutdowns in 1995-96 (in inflation-adjusted dollars).

The Congressional Research Service in December 2018 released a mid-shutdown comprehensive look at shutdowns, beginning with short ones during the Carter administration. It was Carter’s Attorney General Benjamin Civiletti who issued opinions that set in motion a much stricter interpretation of the agency’s freedom to spend during an appropriations lapse. “For years leading up to 1980,” the CRS said, “many federal agencies continued to operate during a funding gap, minimizing all non-essential operations and obligations, (assuming) that Congress did not intend that agencies close down” while waiting for the enactment of annual appropriations acts or continuing resolutions.

The Congressional Research Service’s history of how agencies have executed their contingency plans during shutdowns also notes the difficulties in calculating the costs. “Costs to whom?” it asked. “For something to count as a shutdown-related cost, must it be a cost for the federal government or a distinct part of the federal government? How should costs be handled that accrue to a state or local government (e.g., delayed grant funding), a citizen or client (e.g., lost services), a business (e.g., less tourism revenue), or society at large (e.g., reduced economic output)? What if one stakeholder’s cost (e.g., a contractor’s lost work and compensation) may be viewed as savings or a benefit for another stakeholder (e.g., cost savings for an agency, albeit with less work effort toward the agency mission)?”

The anecdotal costs to employees at specific agencies are more vivid. At the Internal Revenue Service’s Exempt Organizations division, for example, the processing of nonprofit applications for tax-exempt status was severely curtailed during the 2018 shutdown, with only 24 employees deemed essential.

According to an American Bar Association roundtable talk on January 18, 2023 by tax attorney Meghan Bliss of Caplin & Drysdale, “There’s a person in the mail room, though, who will accept your Form 1023. They’re essential. They stamp it as received and cash your check,” she said. But “there is no one else to take your calls or work your applications or do your examinations.”

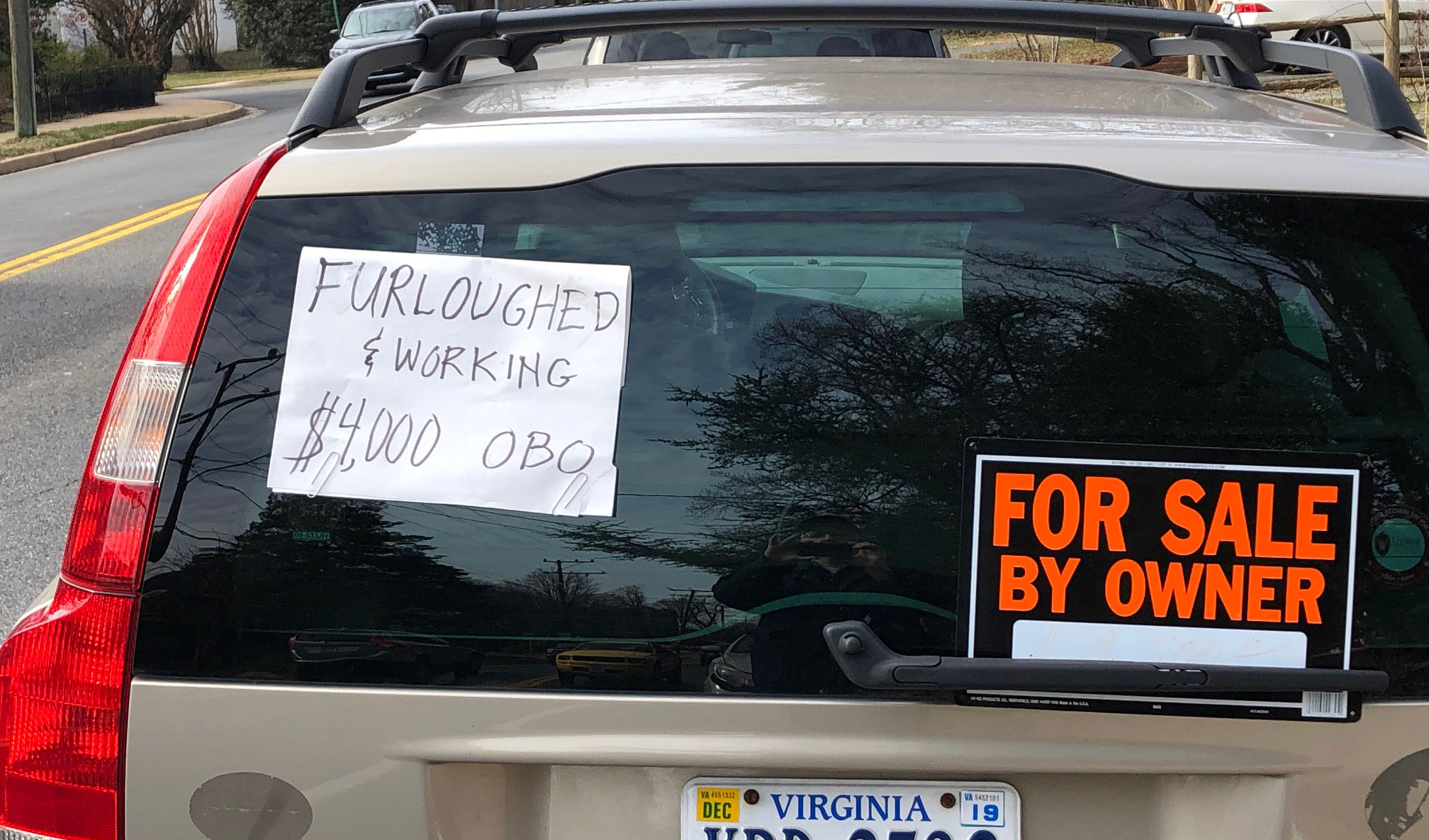

The financial hardships to employees at the State Department were detailed in a roundup from an officer of the American Foreign Service Association. “Some members had already tapped into their ‘rainy-day fund’ after being forced to leave Mission Russia last year. Others had to juggle their funds to pay tuition expenses or mortgages due in January,” the group noted.

What emerges as the proper interpretation of agency obligations under the Antideficiency Act will depend on the courts, and on the Government Accountability Office, which referees such decisions. Julia Matta, the GAO’s managing associate general counsel, testified on February 6, 2019, before the House Appropriations Subcommittee on the Interior: “The Antideficiency Act is the only fiscal statute that includes both civil and criminal penalties for a violation,” she said. Those who violate it “are subject to administrative discipline, such as suspension or removal from office, as well as criminal penalties in the case of a knowing and willful violation.”

But she split hairs on what happens during a shutdown. “As an initial matter, certain agencies and programs may continue to operate, without implicating the Anti-deficiency Act if the agency or program has available budget authority. Such authority may derive from multiple-year or no-year appropriation-carryover balances, or otherwise available balances from other authorities, such as from fee income that Congress made available for obligation,” Matta said.

In lost cases, transferring funds requires notification of Congress. And “an agency must still ensure that it adheres to all other applicable laws,” she said. “Sometimes, an agency may have two appropriations that may arguably be available for the same purpose. In those cases, an agency must elect to use a single appropriation. The agency may not switch to a different appropriation merely because the one it chose first is now depleted.”

Lawmakers in 2019 drafted bills designed to force reforms in the budget process that would require their colleagues to keep the government open automatically, by continuing funding, for example, at the previous year’s levels. The Prevent Government Shutdowns Act (S. 589), by Senators James Lankford, R-Okla. and Maggie Hassan, D-N.H. would have required that, if appropriations bills are not passed by both chambers of Congress and signed by the president by October 1, “no official travel will be allowed for Office of Management and Budget leadership or staff, Cabinet members, or senators and representatives, along with their committee and personal staffs (except for official travel within the D.C. metro area).”

Other solutions have included switching from annual to biennial budgeting. That would be “a nightmare,” said Paul Light: “I don’t see Congress losing its control over the budget; it’s too important to the electoral cycle, and Congress is nothing if not diligent in claiming credit for all spending,” he said. Plus, the then-Democratic House, in negotiating with a Republican-controlled Senate, was “not going to go along with any kind of weakening of oversight on the budget.” Such propositions are “politically naïve,” he said.

What complicates the challenge, added Norman Ornstein, “is not just the tribal environment and maneuvering to gain advantage, but also the breakdown of regular order, which goes back even further. The inability to finish appropriations bills on time, much less reach agreement, creates a greater likelihood of shutdowns.”

In moving forward, the Cato Institute’s Chris Edwards said, “both parties know there’s a problem with shutdowns. The solution is pretty straightforward — an automatic continuing resolution at the same spending levels if the parties don’t agree on discretionary levels. It’s a fair and neutral approach.” Unlike the messy issues of immigration and healthcare, he said, “both parties know the solution. So, why not get together and make the trains run on time?”